15 Must-Have Sales Pipeline Reports for Sales Leaders in 2026

Why Traditional Sales Pipeline Reports No Longer Give Sales Leaders Real Visibility

If you are a CRO or a VP of Sales, you likely live in your CRM. You have dashboards for everything: total pipe generation, weighted forecast, activity metrics, and stage conversion rates. Yet, despite this ocean of data, the end of the quarter still brings surprises. Deals that were "committed" on Monday slip by Friday. "Sure things" go dark. Reps assure you the meeting went well, but the opportunity stagnates in Stage 2 for three months until it quietly dies.

The uncomfortable reality for many sales leaders is that traditional sales pipeline reports provide an illusion of control rather than actual visibility. Standard CRM reporting tells you what happened, or what the rep claims is happening, but it rarely explains how it is happening or why deals are stalling.

We are currently witnessing a fundamental shift in how high-performing revenue organizations manage their pipelines. The era of generic activity tracking—counting dials and demos—is ending. It is being replaced by a demand for deep, behavior-based insights. Leaders are no longer satisfied with knowing a call took place; they need to know if the new product was pitched, if the competitor’s pricing objection was handled, and if the rep is truly multi-threading or just clinging to a single friendly contact.

This shift is driven by necessity. In a tighter economic environment, the margin for error in the forecast has vanished. You cannot afford to carry a "bloated" pipeline that looks healthy on a dashboard but is rotting on the inside. You cannot afford to let reps "freestyle" the sales process when you have a proven playbook that yields results.

The following guide details 15 specific sales pipeline reports that move beyond vanity metrics. These are not default reports found in a basic CRM setup. They are sophisticated, question-driven reports designed to answer the critical strategic questions that keep leaders awake at night. They focus on risk, execution quality, and revenue leakage.

15 Pipeline Reports Sales Leaders Need to Run a Predictable Revenue Engine

Here is the blueprint for the 15 pipeline reports you need to run a predictable, low-risk revenue engine. Implementing these reports allows you to move from being a reactive scorekeeper to a proactive architect of revenue. It enables you to intervene when a deal is wobbling, not after it’s lost. It allows you to distinguish between a rep who is busy and a rep who is effective.

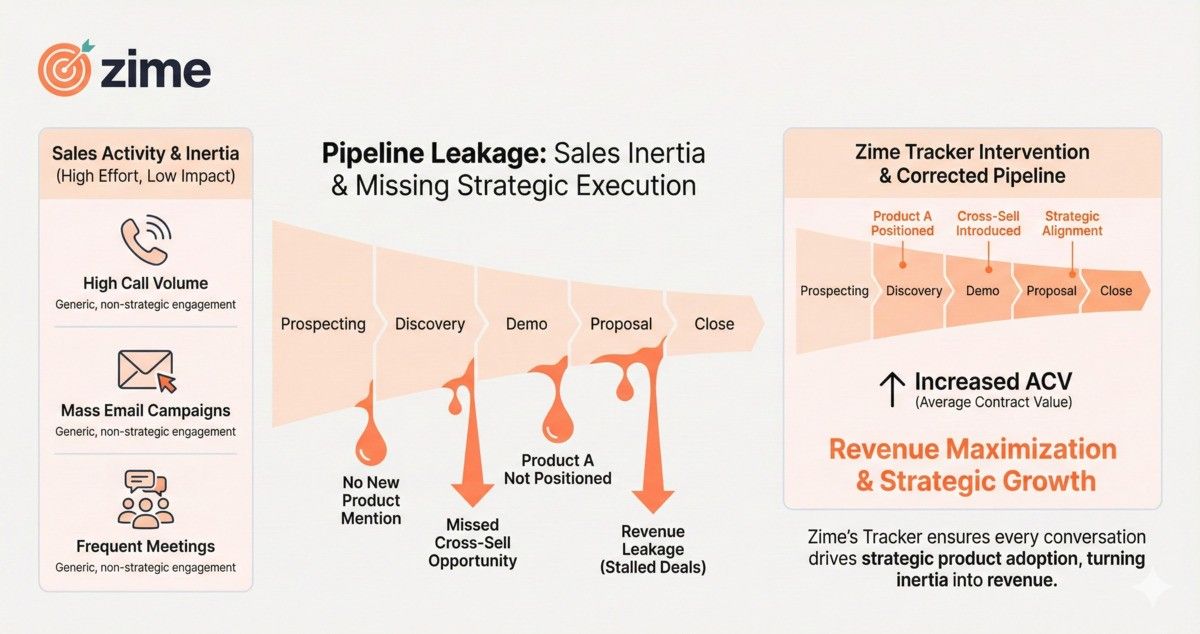

1. New Product Penetration & Cross-Sell Tracker

Launching a new product or feature is one of the most expensive and high-stakes initiatives a company undertakes. Marketing spends budget on air cover, product teams burn midnight oil, and enablement builds decks. Yet this is a recurring theme across modern sales enablement challenges: the sales team forgets, or refuses, to pitch it.

For many Sales Leaders, the "New Product Cross-Sell" report is the only way to verify that the go-to-market strategy is actually entering the conversation. The leadership problem here is "revenue leakage" due to inertia. Reps are creatures of habit; they sell what they know. If you are banking on a new module (like a "Smart Scheduler" or "Zero Slate" add-on) to drive ACV expansion, you cannot rely on trust alone.

Why This Report is Critical

Without this report, you are flying blind on product adoption. You might suspect you are losing revenue because reps aren't cross-selling, but you lack the data to prove it. This report acts as a "dictionary" of product mentions, using conversation intelligence or rigorous CRM tagging to verify if the new strategic narrative is being verbalized during customer interactions.

Leadership Action

When you see a rep with high activity but zero mentions of the new product, the intervention is clear. It isn't a pipeline problem; it's a coaching or confidence problem. This report allows you to isolate the specific reps who are failing to execute the new strategy and course-correct immediately, rather than waiting for a quarterly product review to realize the launch flopped.

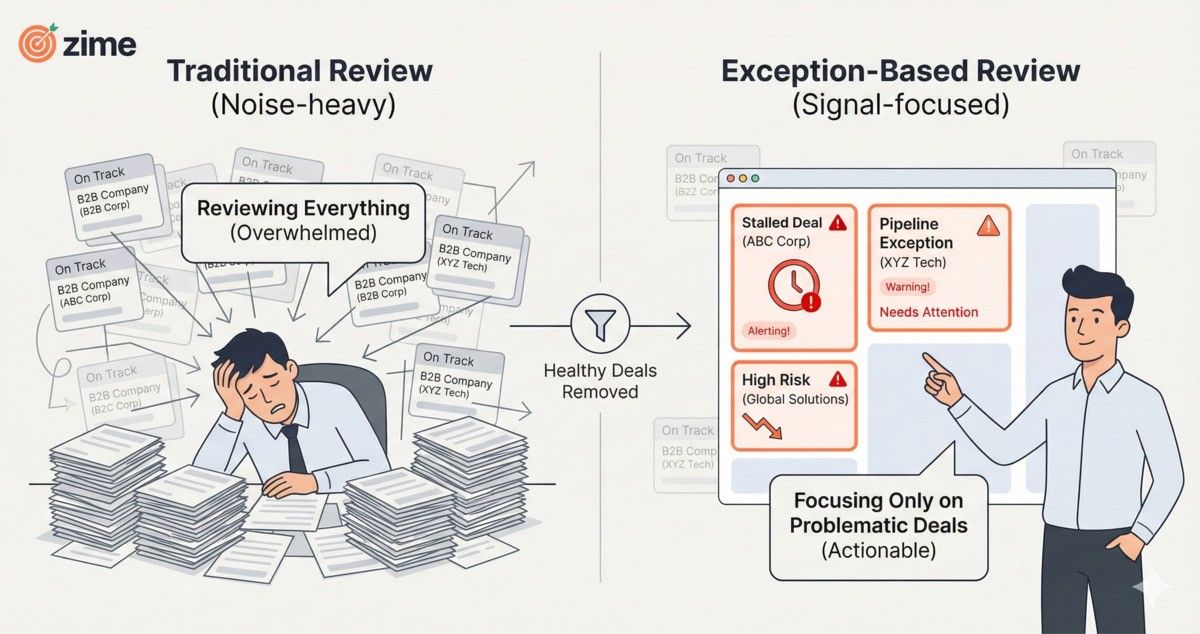

2. Stalled Deal & Pipeline Exception Analysis

In high-volume sales environments, such as SMB or mid-market teams handling dozens of calls daily, a Sales Manager cannot physically review every single deal. The "manage everything" approach inevitably leads to manager burnout and shallow deal reviews where nothing of substance is discussed.

The "Pipeline Exception Dashboard" flips the traditional review model on its head. Instead of reviewing the healthy pipeline, this report filters out the deals that are progressing normally and exclusively flags the "3, 4, or 5 deals" that are stuck, risky, or deviating from the norm.

The Shift in Logic

This is management by exception. The goal is efficiency. If a deal is moving stage to stage within the expected velocity, leave it alone. A leader’s time is most valuable when focused on anomalies, such as deals stalled in negotiation, opportunities where the close date has slipped multiple times, or accounts where communication has gone silent.

Strategic Value

This report allows leadership to "deep dive" where it matters. It stops the waste of time spent discussing deals that are already on track and focuses 100% of leadership energy on unblocking revenue that is currently at risk, supported by the right sales productivity metrics. It turns the forecast call from a status update into a problem-solving session.

3. Lead Stagnation & Drop-Off Root Cause Report

One of the most frustrating patterns in pipeline management is the "silent death" of a lead. A prospect has an initial conversation, shows interest, and then simply "goes cold" without a clear reason. They don't say no; they just stop responding.

Traditional reporting marks this as "Closed Lost: Ghosted" or "No Decision." This is insufficient for a Sales Leader who needs to fix the funnel. You need to know why the silence happened. Did the rep miss a critical pain point? Were objections raised that went unaddressed?

Why You Need This

This report provides “external validation” on stalled deals. It forces an analysis, often using automated follow-up surveys or call recording analysis, to categorize the stagnation. Currently, many organizations have “no idea” why these leads drop and rely on guesswork.

The Fix

By clustering the reasons for stagnation (e.g., "Budget freeze," "Competitor feature gap," "Poor follow-up"), you can detect systemic issues. If X% of deals go cold after the demo, you likely have a "feature dumping" problem rather than a value-selling problem. This report transforms "ghosting" from a mystery into a solvable process gap.

4. Customer Expansion & Proactive Discovery Monitor

In the SaaS world, the "flywheel effect" is the holy grail of growth: existing customers buying more, staying longer, and becoming advocates. However, many organizations treat Account Management as support rather than sales. They wait for the renewal date to speak to the customer.

The "Farming & Proactive Discovery Report" is designed to combat this passivity. It tracks whether reps are engaging in "proactive discovery" to expand wallet share long before the renewal is due.

The Leadership Lens

You likely have customers using your product who have "never talked to you about your service agreement" or premium modules. That is dormant revenue. This report measures the frequency and quality of non-support interactions. Are your AMs discussing business goals? Are they cross-pitching consulting services?

Operationalizing Growth

This visibility is critical to verifying if your "farmer" reps are actually farming or just caretaking. It allows you to measure the penetration of the account base and ensure that every customer is being evaluated for upsell potential, driving Net Revenue Retention (NRR) systematically rather than accidentally.

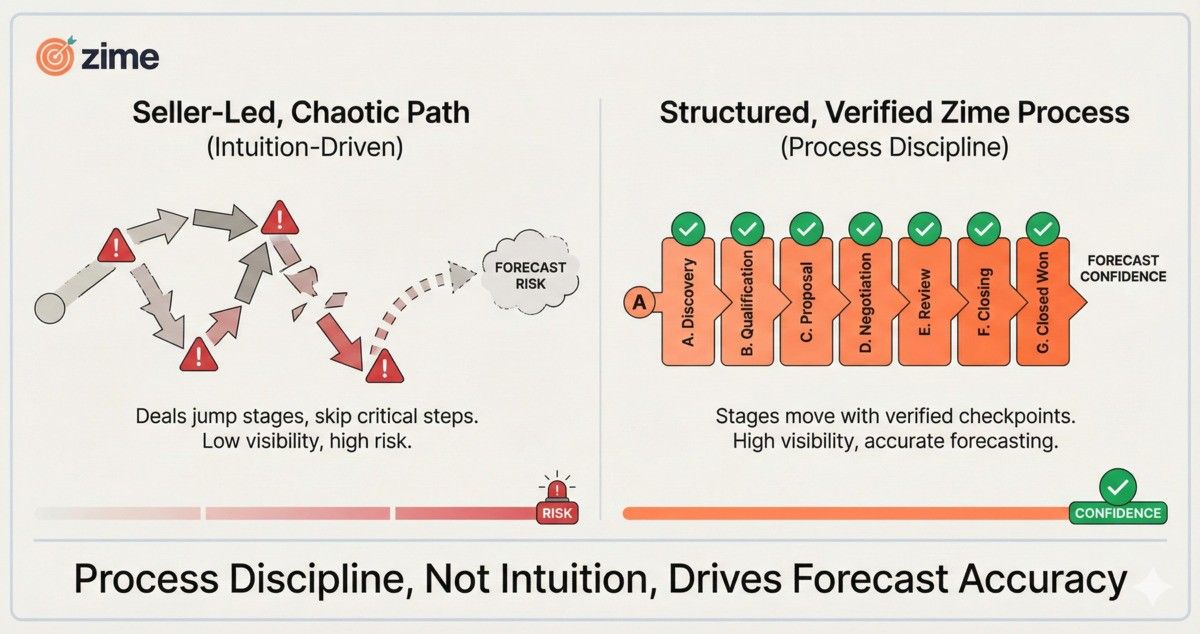

5. Sales Process Adherence & Stage Velocity Report

For enterprise teams with sales cycles stretching 9 to 18 months, the "art" of sales often obscures the science. Leaders feel like they are at the mercy of individual seller styles. You might hear, "Don't worry, I have a good relationship with them," but have no data to back up whether the deal is actually structurally sound.

This report is often described as the "Holy Grail" of pipeline visibility. Its purpose is to measure if reps are following a "standard set of activities" at each stage of the journey—from Point A to Point G.

What It Unlocks

The objective is to ensure reps are not "letting the seller lead the process." A deal should not move to "Proposal" just because the customer asked for a price. It should move there because specific exit criteria—verified pain, access to power, agreed-upon timeline—have been met.

Behavioral Insight

This report flags deals that skip steps. If a deal jumps from Discovery to Negotiation without a Validation event, it is a high-risk anomaly. Platforms like Zime are increasingly used here to automate the verification of these steps, ensuring that the "proven path to closure" isn't just a suggestion in a handbook, but a measured reality. This ensures that your forecast is based on process rigor, not optimism.

6. Competitive Win/Loss & Objection Analysis

Generic "Win/Loss" reports are often useless. Knowing you lost to a competitor is not enough. You need to know "what led us to win, and what led us to lose" against specific rivals in specific contexts.

The "Competitive Intelligence Dashboard" moves beyond the outcome and analyzes the battle. It tracks the specific objections raised during the cycle and the sentiment shifts that occurred when a competitor was mentioned.

Preventing the Downsell

This intelligence is crucial for preventing "downsell" or discounting panic. If you know that Competitor X always attacks your implementation fees, you can train reps to innoculate against that objection early.

Strategic Air Cover

Furthermore, this report acts as an early warning system. When the report flags that a specific competitor is involved or that sentiment is dropping, it allows leadership to bring in “air cover,” such as executives or product experts, immediately. Rather than waiting until a deal is marked as “Lost,” teams can intervene as soon as a competitive threat is detected and proactively change the trajectory of the deal.

7. Executive Engagement & Deal Sentiment Forecast

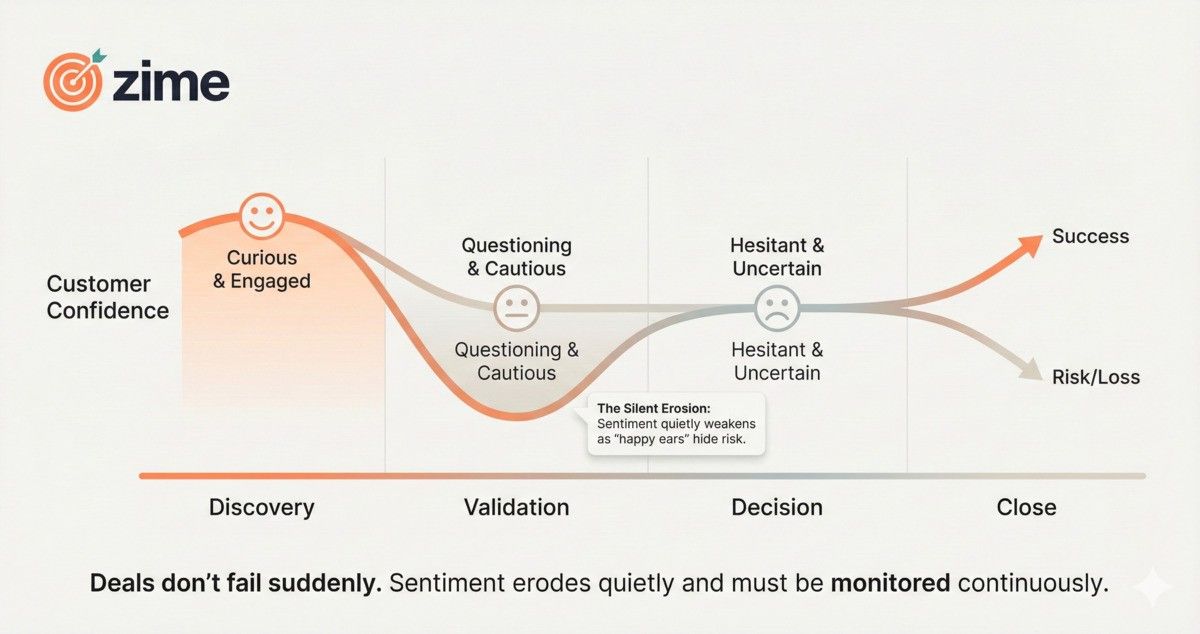

In large "broadcast deals" (often $1M+ ARR), the sales cycle is a marathon. The danger is that a rep maintains a "Happy Ears" disposition while the account slowly sours over months. Leaders need a way to track if "confidence and sentiment is positive" consistently throughout the long cycle.

This report tracks the emotional and qualitative health of the deal, often leveraging AI analysis of email and call tone. It answers the question: Is the customer's enthusiasm waxing or waning?

The "Air Cover" Trigger

The primary utility of this report is risk detection. It identifies moments where "objections are being asked and there is not enough answer." If sentiment dips in the "Validation" stage, it signals that the champion might be losing internal capital or that a technical blocker has emerged.

Decision Making

This is the signal for Executive Sponsorship. It tells the CRO exactly where to spend their time. Instead of asking "How can I help?" On every deal, you deploy executive support surgically to accounts where sentiment is fragile, effectively "saving" the deal before it is formally lost.

8. Stakeholder Multithreading & Buying Committee Depth

The single biggest point of failure in enterprise sales is the "single thread." A rep relies entirely on one champion. If that champion leaves, gets fired, or loses influence, the deal dies instantly.

The "Multi-Threading & Stakeholder Depth Report" verifies if reps are talking to multiple stakeholders across the organization. It visualizes the buying committee: Do we have a contact in Finance? Do we have a contact in IT? Have we reached the decision-maker?

Protecting New Business

This is critical for "growth and new business" teams. It validates that reps are reaching decision-makers early rather than getting stuck at the manager level.

The Resilience Factor

By enforcing multi-threading visibility, you ensure your pipeline is resilient. If a champion leaves, the deal survives because the rep has already built bridges with three other stakeholders. This report exposes the "hollow" deals in your pipeline that look big but are supported by a single, fragile relationship.

9. Value Engineering & Business Case Verification

Many deals stall at the finish line not because the product is bad, but because the rep failed to build a business case that the CFO could approve. It is common to identify a gap where reps are failing to build a solid "ROI business case" during calls.

The "ROI & Business Case Construction Report" tracks the presence and quality of value quantification in the sales process. It asks: Has a verified ROI calculation been shared? Has the customer validated the inputs?

Why It Matters

In a downturn, CFOs are the ultimate gatekeepers. They don't buy features; they buy financial outcomes. This report tracks whether reps are effectively quantifying value and building a financial case.

Leadership Insight

If you see a pipeline full of deals without attached business cases, you are looking at a pipeline of "nice-to-haves," not "must-haves." This report forces the sales team to move from selling functionality to selling financial impact, which is essential for closing complex enterprise deals.

10. Champion Engagement & Upsell Scalability Report

For companies with massive install bases, manually checking every account is impossible. Some organizations have hundreds of thousands of champions across their accounts and need a scalable way to track engagement.

The "Champion Engagement Report" monitors the activity levels of your key advocates across the entire customer base. It flags when a champion becomes hyper-active (signaling potential upsell) or goes dormant (signaling churn risk).

The "Wildfire" Effect

This report is essential for identifying specific upsell triggers—sometimes referred to internally as "wildfire activities"—where usage spikes or new teams start logging in. It allows Sales Leaders to identify upsell opportunities across a massive base without manual intervention.

Revenue Implications

This ensures no revenue opportunity is missed due to lack of attention. It automates the "tap on the shoulder" for the Account Manager, telling them, "Account A is showing buying signals right now; call them."

11. First-Call Efficacy & Qualification Conversion Report

The most expensive resource in your sales organization is the time your Account Executives spend on bad leads. Leaders often see leads drop off immediately after the first call and struggle to pinpoint if it's a lead quality issue (Marketing) or a sales skill issue (Sales).

The "Initial Qualification Report" measures the quality of the very first interaction. It analyzes whether the rep "intensified pain" and "quantified pain" sufficiently to warrant a next step.

The Quality Gate

This report acts as a quality gate for the pipeline. It stops the "garbage in, garbage out" cycle. If a rep converts 100% of first calls to pipeline but closes 0%, they are skipping qualification. If they convert 0%, they may lack discovery skills.

Diagnostic Power

This visibility allows you to distinguish between a rep who needs training on "pain intensification" and a lead source that is providing unqualified prospects. It brings scientific rigor to the top of the funnel.

12. Strategic Account Wallet Share & White Space Analysis

For your top strategic accounts, the “must-win” logos, generic reporting is insufficient. You need a rigorous report on “share of wallet” expansion. This is crucial for project-based initiatives, such as “AccountMax,” that are aimed at the top tier of your client list.

The "Wallet Share Expansion Report" maps the "white space" in your most valuable accounts. It tracks which divisions have been sold to and which are wide open.

Measuring Rigor

This report is critical to verify if your quarterly business reviews (QBRs) and account planning processes are theoretical or practical. Is the "quarterly rigor" actually resulting in new opportunities?

The Strategy Check

If you spend days planning account strategy but this report shows zero new pipeline in those accounts, your planning process is broken. This report holds the Strategic Account Managers accountable for true expansion, not just renewal.

13. CRM Hygiene & Data Enrichment Audit

Data friction is the enemy of sales velocity. Reps hate manual entry, and because they hate it, they do it poorly. Yet, leaders need 10 different fields (tech stack, employee count, frameworks) to run automation and marketing segmentation.

The CRM Data Hygiene & Automation Report monitors the completeness of CRM data without relying on manual rep entry. It tracks how effectively tools are extracting data directly from calls into the CRM.

The Time-Value Proposition

This is important because reps "don't have enough time" to be data entry clerks. If you force them to type, they sell less.

The Automation Engine

Accurate data is the fuel for your marketing automation and follow-up sequences. This report ensures that the fuel is clean. It flags records that are missing critical fields so that automation rules don't fail, ensuring that the "admin tax" on reps is minimized while data quality remains high.

14. Narrative Fluency & Technical Competency Scorecard

In a complex market, "hustle" is not enough. Reps need the "chops" to sell complex narratives like "AI-first" or "Data-first" architectures. A rep might be motivated by incentives, but if they lack the "technical chops" to differentiate the solution, they will lose to a more knowledgeable competitor.

The "Rep Skill Gap Analysis" measures competency, not just activity. It uses conversation intelligence to score reps on their ability to articulate specific value propositions.

Coaching Precision

This report identifies exactly who needs coaching on which narrative. Instead of generic "sales training," you can assign specific modules to Rep A on "Security Architecture" and Rep B on "ROI Calculation."

Differentiation

This is how you ensure your team is not just selling a commodity. It verifies that the "consultative" approach you promised the board is actually happening on the phones.

15. Talent Acquisition Funnel & Candidate Experience Metrics

Finally, the discipline of pipeline reporting should extend to the people who build the pipeline: your recruiters. This is a unique application of sales intelligence to the talent acquisition team.

The "Recruiter-Candidate Quality Scorecard" treats the candidate as a customer who needs to be won. It acts as a "playbook" for recruiters to ensure they are "selling" the company correctly.

The War for Talent

Just as you track objection handling in sales, this report tracks objection handling in recruiting. Are recruiters handling comp objections well? Is the company vision being pitched consistently?

Building the Bench

This ensures that your talent pipeline is as rigorous as your revenue pipeline. It validates that recruiters are executing the "sale" of the company effectively, ensuring you land the high-quality reps you need to hit the number.

Conclusion: From Visibility to Predictability

The difference between a Sales Leader who is constantly fighting fires and one who sleeps well at night is not the size of their pipeline—it is the fidelity of their reporting.

The 15 reports outlined above represent a maturity curve. They move away from the "rearview mirror" of traditional dashboards and look through the windshield. They prioritize behavior over activity and risk detection over optimism.

If you are relying solely on the "probability to close" percentage in your CRM, you are betting your tenure on a guess. By implementing reports that track methodology adherence, business case construction, and multi-threading depth, you remove the guesswork. You empower yourself to make decisions based on the reality of the deal, not the hope of the rep.

Your Next Step

Conduct an audit of your current reporting stack.

- Do you have a way to spot "ghosted" deals instantly?

- Can you prove your reps are multi-threading?

- Do you know why you are losing to your top competitor, specifically?

If the answer to these is “no,” pick two reports from this list, such as the Stalled Deal Analysis and the Sales Process Adherence Report, and prioritize their construction this quarter. The cost of not having them is simply too high.

Frequently Asked Questions (FAQs)

1. What are sales pipeline reports, and why are they critical for sales leaders in 2026?

Sales pipeline reports are structured analytics views that help sales leaders understand how deals move through each stage of the revenue funnel. In 2026, they are critical because traditional CRM dashboards focus on lagging indicators like deal value and stage probability, while modern pipeline reports reveal deal risk, execution quality, and behavioral gaps. These insights allow CROs and VPs of Sales to proactively intervene before deals stall or forecasts break.

2. How are modern sales pipeline reports different from standard CRM dashboards?

Standard CRM dashboards primarily show what happened—activities logged, stages updated, or revenue booked. Modern sales pipeline reports go deeper by explaining why deals are progressing or failing. They analyze factors such as stalled deal patterns, sales process adherence, stakeholder coverage, objection handling, and sentiment trends. This shift helps leaders move from reactive reporting to predictable, execution-driven revenue management.

3. Which sales pipeline reports have the biggest impact on forecast accuracy?

Reports that directly measure deal risk and execution rigor have the highest impact on forecast accuracy. These include:

- Stalled Deal & Pipeline Exception Analysis to surface hidden risk

- Sales Process Adherence & Stage Velocity Reports to prevent premature forecasting

- Stakeholder Multithreading Reports to reduce single-champion dependency

Together, these reports reduce pipeline inflation and ensure forecasts are grounded in deal reality, not rep optimism.

4. How can sales leaders ensure their sales pipeline reports reflect real deal execution, not just CRM updates?

Most CRM-based sales pipeline reports rely on rep-entered data, which often reflects optimism rather than reality. To ensure reports capture actual deal execution, leaders need visibility into what was said, positioned, and validated during buyer interactions. Platforms like Zime bridge this gap by connecting pipeline stages to real sales behaviors—such as product mentions, objection handling, stakeholder engagement, and business case validation—so pipeline reports are grounded in execution truth, not assumptions.

5. How should sales leaders start implementing advanced sales pipeline reporting?

Sales leaders should begin by auditing their existing reports and identifying blind spots. A practical approach is to prioritize two high-impact reports—such as stalled deal analysis and sales process adherence tracking—before expanding further. Starting small ensures adoption, builds internal trust in the data, and creates momentum toward a fully predictable revenue engine.